Wednesday, 18th December 2024

The International Group (IG) Pooling and Group Excess of Loss Reinsurance contract (GXL) structure for the 2025/26 Policy Year has now been finalised.

This press release details the background to the IG’s GXL renewal rates for 2025/26 policy year.

Following a relatively benign Pool claims environment for the 2022/23 and 2023/4 Policy Years, the 2024/5 policy year has so far seen a move back towards a higher level of pool claims activity, more consistent with the 2019-2021 period, as well as the Baltimore Bridge incident. It has also been a slightly more difficult year for the Group’s reinsurance partners with an active hurricane season.

The GXL allows IG Clubs to offer uniquely high levels of free and unlimited coverage for most of the risks they insure. In securing this renewal, the IG is therefore grateful for the ongoing support of its leader, AXA XL, and also to its many other longstanding reinsurance partners.

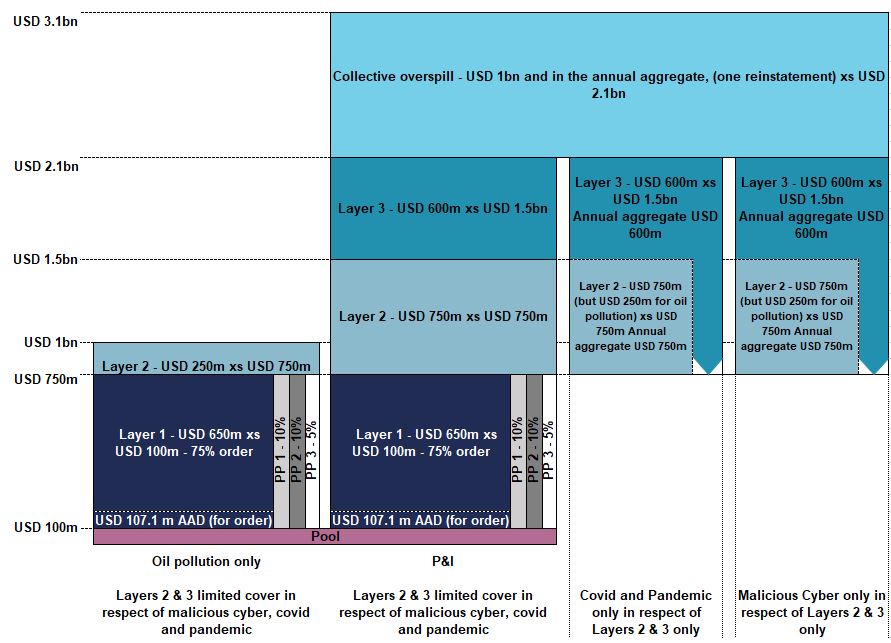

As part of the GXL, the IG maintains three private placements amounting to 25% of Layer 1 of the programme (USD 650m xs USD 100m).

For Layers 2 and 3 the COVID-19/Pandemic risk aggregated cover was split last year from the Malicious Cyber aggregated cover. For both these risks there continues to be free and unlimited for all claims up to USD 650m xs USD 100m and two towers of separate aggregated cover for claims above USD 750m up to US$2.1 billion.

To ensure the fairness of cost allocation between different vessel types, each year the IG’s Reinsurance Committee considers the vessel categories used. Having given due consideration to possible variations, those categories remain unchanged with the rates having been adjusted as set out in detail at the end of this release.

Statement from Mike Hall, Chairman of the IG’s Reinsurance Committee

“The renewal this year has been a challenging one given the Baltimore Bridge loss.Thanks to constructive engagement with our leader Axa XL and the rest of our panel of reinsurers we have achieved a fair renewal outcome for all parties. The Group places great value on its longstanding relationships with our reinsurers and the fact that we have renewed our programme on equitable terms and within the normal timeframe demonstrates the value of this partnership. My thanks to our reinsurers and the IG’s brokers for their continued support.”

Renewal Overview

The main GXL placement (Layers 1-3, USD 2 billion excess of USD 100m) has been maintained as three layers. There continues to be the USD 1 billion Collective Overspill cover excess of the GXL together with three private placements in Layer 1 (maintaining the 25% overall share).

An overview of the entire GXL for 2025/26 is as follows:

o Individual Club’s retention on any claim remains at USD 10 m;

o Claims are pooled between Group Clubs for USD 90 m excess USD 10 m;

o Excess USD 100 m, the GXL applies as follows:

o Layer 1 USD 650 m excess USD 100m; Layer 2 USD 750 m excess USD 750 m; Layer 3 USD 600 m excess USD 1.5 bn;

o 75% of Layer 1 and 100% of Layers 2 and 3 are placed with the open market on a free and unlimited basis, except for risks in respect of malicious cyber, COVID-19 and Pandemic. For those risks, for the 2025/26 policy year, there remains free and unlimited cover for claims up to USD 650m excess of USD 100m. This covers almost all IG Clubs’ certificated risks. Excess of USD 750m there is up to US$1.35bn of annual aggregated cover in respect of Malicious Cyber cover and separate annual aggregated cover of USD1.35bn in respect of pandemic/Covid risks. Excess of that aggregated cover, the IG continues to pool any reinsurance shortfall, resulting in no change to shipowners’ cover.

o 25% of Layer 1 is covered by three private market placements, which are renewed independently of the open market element of the GXL;

o Hydra continues to retain an Annual Aggregate Deductible (“AAD”) in Layer 1, which remains at the same value as for the 2024/25 policy year in 100% terms. With the open market layer at 75%, the value of this AAD remains at USD 107.1m for the 2025/26 policy year.

o Other placements: The Collective Overspill (USD 1bn excess of USD 2.1 bn) and ancillary covers are being renewed with premiums included within the overall rate per GT.

The IG’s Bermudan based reinsurance captive Hydra continues to support the IG through its risk retention. This enhances stability in pricing. The use of private placements has also continued to give shipowners greater stability.

The GXL continues to allow the broadest cover for shipowners.

Individual Club retention and GXL programme attachment

Following a comprehensive review of the retention structure it has been decided to maintain the Individual Club Retention unchanged for the 2025/26 policy year at USD 10 million, as does the structure of the Pool and the attachment point for the GXL.

MLC cover

The MLC market reinsurance cover is being renewed for 2025/26 at competitive market terms, with the premium included in the overall reinsurance rates charged to shipowners.

War cover

The excess War P&I cover will be renewed for 2025/26 for a period of 12 months. Again, this will be included in the total rates charged to shipowners.

However, due to the ongoing active war between Russia and Ukraine, the IG’s Excess War reinsurers have maintained their requirement for Territorial Exclusion language (consistent with exclusionary language already applied by reinsurers for Primary War P&I coverage) for vessels trading in these waters. As such the Group has purchased aggregated sublimited cover of US$100m from the reinsurance markets to cover the Russia/Ukraine/Belarus excluded risks.

2025/6 GXL programme structure

The diagram below illustrates the layer and participation structure of the GXL programme for 2025/6.

Reinsurance cost allocation 2025/26

As mentioned above, as part of its annual analysis and in addition to reviewing premiums, the IG’s Reinsurance Committee has looked at vessel categories.

The conclusions are that there should be no change in the number of categories at this time, but that there should be some adjustments to the relative rate changes having regard to each category’s historical claims performance against the GXL.

The 2025/26 rates are set out below:

|

Tonnage category |

2025 rate in US cents per GT |

% change in rate per GT |

|

Persistent Oil Tankers |

62.58 |

+1.5% |

|

Clean Tankers |

43.37 |

+8.9% |

|

Dry |

60.54 |

+3.3% |

|

FCC |

89.03 |

+23.6% |

|

Passenger |

343.90 |

+1.6% |

|

Chartered tankers |

32.46 |

+3.8% |

|

Chartered dries |

15.77 |

+3.3% |

Mike Hall – Chair of the International Group Reinsurance Committee

18 December 2024